COMPARATIVES

The following paragraphs describe the impact in relation to the new standards, amendment to published standard that have been adopted by the Group on the comparatives of the financial statements.

(a) FRS 8 “Operating segments”

FRS 8 “Operating segment” requires a “management approach”, under which segment information is presented on the same basis as that used for internal reporting purposes. This has resulted in an increase in the number of reportable segments as compared to the previously reported segments as follows:

(i) Engineering and Construction;

(ii) Concessions (which also includes Infrastructure and Investment) and

(iii) Operating and Maintenance.

The adoption of FRS 8 “Operating segment” has resulted in a consequential amendment to FRS 136 “Impairment of assets” in respect of the allocation of goodwill for impairment testing. As a result, each unit or group of units to which goodwill is allocated shall not be larger than an operating segment determined in accordance with FRS 8 instead of the previous standard, FRS 114 “Segment reporting”.

The change in reportable segments of the Group has not resulted in any additional goodwill impairment. Other than the segment presentation change, there was no impact on the measurement of the group’s assets and liabilities.

(b) IC Interpretation 12 “Service concession arrangements”

The early adoption of IC Interpretation 12 has resulted in a change in accounting policy for concession consideration components of construction services (FRS111) and operation services (FRS118) generated from Service Concession Agreements.

Prior to the adoption of this IC Interpretation 12, no construction revenue was recognised from the Service Concession Agreements and the Infrastructure Assets were recognised as property, plant and equipment of the Group. This change in accounting policy requires that the fair value of construction revenue be recognised as financial assets and the effect has been accounted for retrospectively in accordance with requirements of FRS 108 – Accounting policies, Changes in Accounting Estimates and Errors. Comparatives have been restated to conform to current year’s presentation.

The effects on prior year’s consolidated financial statements are set out below.

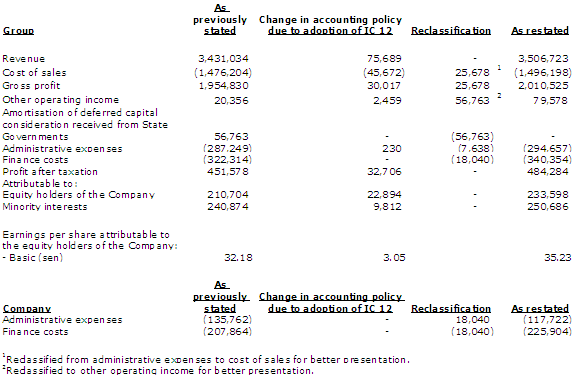

Restatement of the income statements for the financial year ended 30 September 2009

The following table discloses the adjustments that have been made in accordance with the change in accounting policy to each of the line items in the Group and Company’s income statement for the financial year ended 30 September 2009 and reclassification of prior year’s comparatives to conform with current year presentation.

Restatement of the balance sheets as at 30 September 2009

The following table discloses the adjustments that have been made in accordance with the change in accounting policy to each of the line items in the Group and Company’s balance sheet as at 30 September 2009 and reclassification of prior year’s comparatives to conform with current year presentation.

Restatement of the cash flow statement for the financial year ended 30 September 2009

The following table discloses the adjustments that have been made in accordance with the change in accounting policy to each of the line items in the Group’s cash flows for the financial year ended 30 June 2009 and reclassification of prior year’s comparatives to conform with current year presentation.