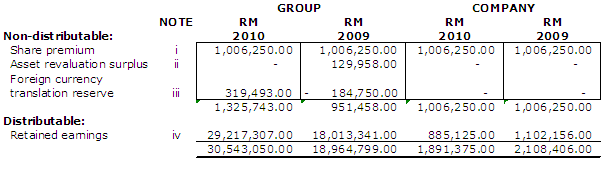

RESERVES

i. Share premium arose from the issuance of 10,575,000 shares of RM1.00 each at a premium of RM0.15 per share, net of listing expenses.

ii. Asset revaluation surplus arose from revaluation of freehold land and buildings and leasehold building in the previous years.

iii. In accordance with the Finance Act 2007, the single tier income tax system became effective from Year of Assessment 2008. Under this system, tax on profits of companies profit is a final tax, and dividends paid are exempted from tax in the hands of the shareholders. Unlike the previous imputation system, the recipient of the dividend would no longer be able to claim any tax credit.

Companies without Section 108 tax credit balance will automatically move to the single tier tax system on January 1, 2008. However, companies with such tax credits are given an irrevocable option to elect for the single tier tax system and disregard the tax credit or to continue to use the tax credits under Section 108 account to frank the payment of cash dividends on ordinary shares for a period of 6 years ending December 31, 2013 or until the tax credits are fully utilised, whichever comes first. During the transitional period, any tax paid will not be added to the Section 108 account and any tax credits utilised will reduce the tax credit balance. All companies will be in the new system on January 1, 2014.

As of the balance sheet date, the Company has not elected for the irrevocable option to disregard the Section 108 tax credits. Accordingly, subject to the agreement of the Inland Revenue Board and based on the prevailing tax rate applicable to dividend, the Company has sufficient Section 108 tax credit and tax exempt income as mentioned in Note XX to frank approximately RM525,000 of the Company‟s retained earnings as of 31 November 2010 if distributed by way of cash dividends without additional tax liability being incurred. Any dividend paid in excess of this amount during the transitional period will be under the single tier tax system as explained above.