Cash Book is used to record cash transactions. However, due to the fact that there is a difference between cheques and the “hard cash”, normally these two types of transactions are recorded in two separate Books of Original Entry – Cheques transactions in Cash or Bank Book (I just refer to it as Cash Book) and “hard cash” transactions in Petty Cash Book.

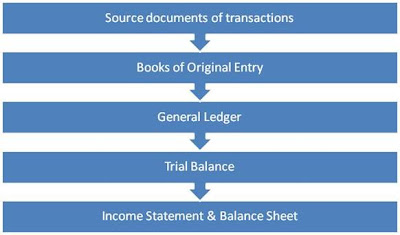

For small businesses, a common format of Cash Book adopted is to present the “T” account and in multi-columns manner. For receipts, the transactions are recorded on the debit side of the Cash Book and for payments, on the credit side of the Cash Book. The total of each column at the end of each month would then be posted to the respective accounts in the General Ledger. The month end balance of each account would then be used to construct the Trial Balance before the Balance Sheet and the Income Statement are prepared (Method 1). However, when the daily collection from customers (it could be cash sales, collections from trade debtors or both), and also payments to suppliers are of large volume, recording of cash receipts in Cash Receipts Day Book or Journal and recording of cash payments in Payments Day Book or Journal may be a better option (Method 2).Refer to the examples in my previous post, “General Ledger? Journals? Day Books? Debtors Ledger? Creditors Ledger? Trial Balance?” and continue with the following additional transactions in the month of February 2007:-

| Transactions in February 2007 | |||||

| Date | Descriptions | Reference No. | Amount | Remark | |

|

1 |

01-Feb-07 |

Receive $3,000 from Big Co Ltd. | OR01022007 | 3,000.00 | Official Receipt No. OR01022007 issued. |

|

2 |

01-Feb-07 |

Cash sales | OR02022007 | 500.00 | Official Receipt No. OR02022007 issued. |

|

3 |

01-Feb-07 |

Collect rental of shop space for the month of February 2007 | OR03022007 | 300.00 | Official Receipt No. OR03022007 issued. |

|

4 |

02-Feb-07 |

Purchase of stationery and printing of documents | PV01022007 | 578.00 | Cheque No: 20021 issued and payment voucher PV01022007 prepared to record payment |

|

5 |

15-Feb-07 |

Cash purchases | PV02022007 | 1,500.00 | Cheque No: 20022 issued and payment voucher PV02022007 prepared to record payment |

|

6 |

16-Feb-07 |

Cash purchases | PV03022007 | 5,000.00 | Cheque No: 20023 issued and payment voucher PV03022007 prepared to record payment |

|

7 |

17-Feb-07 |

Cash Sales | OR04022007 | 1,000.00 | Official Receipt No. OR04022007 issued. |

|

8 |

20-Feb-07 |

Sales on credit to Big Co Ltd. | INV1005 | 2,000.00 | Invoice no. 1005 issued. |

|

9 |

28-Feb-07 |

Cash Sales | OR05022007 | 6,000.00 | Official Receipt No. OR05022007 issued. |

|

10 |

28-Feb-07 |

Pay electricity biil for February 2007 | PV04022007 | 157.89 | Cheque No: 20024 issued and payment voucher PV04022007 prepared to record payment |

|

11 |

28-Feb-07 |

Pay water bill for February 2007 | PV05022007 | 37.87 | Cheque No: 20025 issued and payment voucher PV05022007 prepared to record payment |

|

12 |

28-Feb-07 |

Pay telephone bill for February 2007 | PV06022007 | 46.68 | Cheque No: 20026 issued and payment voucher PV06022007 prepared to record payment |

|

13 |

28-Feb-07 |

Pay rental for February 2007 | PV07022007 | 1,000.00 | Cheque No: 20027 issued and payment voucher PV06022007 prepared to record payment |

Method 1

Before proceed to recording the above transactions, you should first identify for each transaction what are the Books of Original Entry to use. All transactions EXCEPT transaction No. 8 are cash transactions and therefore Cash Book is to be used. For transaction No. 8 the Sales Day Book is the correct Book of Original Entry to be used.

The Sales Day Book for the month of February 2007 is simple because there was only one transaction for the whole month:-

For ABC Co. Ltd, transaction No. 1 and No. 8 would have an impact on the amount owing by Big Co. Ltd. as at 28 February 2007. As there were no other transactions affecting the other trade debtors, the end balances brought forward from 31 January 2007 (refer to Balance B/F dated 1 February 2007) would also be the balance carried forward to the month of March 2007. The Sales Ledger after incorporating all the transactions in February 2007 would be as follows:-

The Cash Book of ABC Co. Ltd. is as follows:-

ABC Co. Ltd.

Cash at Bank

Northern Bank, Account No.: 123-456-789

Debit Side (Cash Receipts) Of the Cash Book

Credit Side (Cash Payments) Of the Cash Book

At the end of February 2007, before ABC Co. Ltd. closes its books, all the transactions recorded in the Books of Original Entry (ie. The Sales Day Book and the Cash Book) would be added up and posted to the General Ledger by way of the following journal entries in the General Journals: –

After the posting of the transactions, the General Ledger would appear as follows:-

Did you notice that Rental Income, Electricity & Water, Telephone, Rent of Premises and Printing & Stationery are the new accounts created as a result of the transactions in the month of February 2007? All these accounts belong to the Income Statement and not the Balance Sheet as they are of income (Rental Income) and expense (Electricity & Water, Telephone, Rent of Premises and Printing & Stationery) in nature.

Also take note that the total of the end balance of each trade debtor in the Sales Ledger as at 28 February of $24,000 (Big Co. Ltd = $2,000; Small Co. Ltd. = $10,000; Not So Big Co. Ltd. = $7,000; Not So Small Co. Ltd. = $5,000) is exactly the same as the end balance of the Trade Debtors account in the General Ledger? The procedure of adding all the end balances in the Sales Ledger and checked for its agreement to the end Trade Debtors balance in the General Ledger is called “Reconciliation of debtors balances to the General Ledger”. This is an important procedure to detect errors of recording transactions in relation to trade debtors.

Based on the end balances of each account in the General Ledger, a trial balance would then be prepared: –

The Income Statement for the two months ended 28 February 2007 (ie. Comprising the month of January 2007 & February 2007) and the Balance Sheet as at 28 February 2007 would then be prepared: –

Method 2

Instead of preparing the Cash Book in “T” account manner, a Cash Receipts Journal and also a Cash Payment Journal are used to record cash transactions.

Referring to the transactions in the month of February 2007, all transactions are cash transactions except for transaction No. 8 and they would be classified into either transaction of receipt in nature or payment and be recorded in the Cash Receipts Journal and the Cash Payment Journal accordingly:-

You would notice the format of the Cash Receipts Journal is exactly the same as the Debit side of the Cash Book as shown in Method 1 and on the other hand, the Cash Payment Journal is the same as the Credit side of the Cash Book. In our example for discussion here, the transactions in February 2007 are minimal and therefore you probably could not see any substantial difference between the two methods. However, just imagine if you are dealing with a business having daily collections of more than 500 cheques and cash from customers and similarly payment of the same volume, you would need a very “long” and “wide” Cash Book, if Method 1 were chosen. Other than the Cash Receipts Journal and Cash Payment Journal, which effectively replaces the Cash Book discussed under Method 1 above, the rest of the records including the Sales Day Book, Sales Ledger, General Journals and the accounts in the General Ledger are the same and therefore I would not shown them again.

The advantage of having a Cash Receipts Journal and a Cash Payment Journal system of recording over the “T” account Cash Book is that the business entity could delegate the two functions i.e. the recording of cash receipts and cash payment to two different persons, whereas under the Method 1 Cash Book system, it is difficult to have two persons sharing the same Cash Book especially if the Cash Book is in the form of hardcopy ledger and not in computer spreadsheet.

Based on what we have discussed thus far, you should be able to see that whenever there are large transactions involved, a separate journal or day book may be a better choice of recording instead of choosing the “One Book for All Transactions” Method. In addition, when you have more than one entity that the business is dealing with, and the business wish to monitor the status of the dealings with these entities concerned such as the situation whereby a business has sales transactions on credit with many customers or purchases transactions with many suppliers, a separate ledger account to be maintained for each of these entities may be required. Can you think of any other situations whereby a separate ledger is maintained for any particular items? Have you heard of Projects Ledger for those companies in which the main activities are project based such as housing developers or contractors? What about stock ledger? Stock cards? Fixed assets register and others? All these ledgers, listing, cards or records created are called generally “Subsidiary Ledgers or Records” in accounting. This is because all these records shows the details or breakdown of a particular account item recorded in the General Ledger and if the end balance of these subsidiary ledgers or records at a particular time are added together, the total amount calculated must tally with the end balance of the respective account recorded in the General Ledger-This is what we called “Reconciliation of Subsidiary Ledgers/Records to General Ledger” in accounting and this is an important internal control procedure that must be performed.