Not sure about these? In my previous post on “ Accounting Documents & Accounting Cycles “, I have discussed the commonly used accounting documents (function is record occurrence of transactions) and also examples of accounting cycles (Sales, Purchases, Cash Receipts Payments).

In order to record the occurrence of transactions in a systematic manner, some form of record keeping must be adopted. The accounting documents such as official receipts, sales invoices, bills etc. are the “Source Documents” in which these documents serve as the evidence of the occurrence of transactions and are based upon to record the transactions as the first entry point of an accounting recording system – “Books of Original Entry”. Examples of books of original entry are the following: –

-

Sales Journal or Sales Day Book – The function is to record sales transactions.

-

Purchases Journal or Purchases Day Book – The function is to record purchases transactions.

-

Cash Book or Bank Book – The function is to record bank transactions.

-

Petty Cash Book – The function is to record petty cash transactions.

-

General Journal – This is used to record those transactions that are not recorded in other books of original entry, i.e. it plays the role of “catching the rest” of the transactions.

Classifying/Grouping Transactions in terms of their frequency of occurrence

Some transactions occur frequently whereas some just occasionally or may be they are of such a pattern that they occur on a fixed intervals – every month, semi annual or annually (Rentals, utility charges, subscription fees & etc).

-

Frequent Transactions

Sales, purchases, receipts from customers and payment to suppliers.

-

Occasional Transactions (No fixed pattern of occurrence)

Disposal of assets (e.g. car, computer), penalty imposed by local council for rules violation, donations to charitable organisations, loss resulting from pilferage of stocks etc.

-

Transactions That Occur On Fixed Intervals

Rental expense, annual trade association member fee, annual audit fee, monthly building management fee.

The books of original entry (Sales Journal or Sales Day Book, Purchase Journal of Purchases Day Book, Cash Book or Bank Book, Petty Cash Book) serve their function best when dealing with the situation of large volume of transactions. It is not necessary that every business always have large volume of transactions. Some businesses have lesser than 20 sales invoices during the whole financial year. In this situation, these business entities have the “option” of not using the Sales Journal or Sales Day Book or the other books of original entry due to low volume of transactions and opt for just recording all the transactions in the General Journal.

Assume ABC Co. Ltd has 4 sales transactions in the month of January 2007 in which the details of the sales are as follows: –

|

Date |

Customers |

Invoice No. |

$ |

| 2007 | |||

| 01-Jan | Big Co. Ltd |

1001 |

3,000.00 |

| 02-Jan | Small Co. Ltd |

1002 |

5,000.00 |

| 15-Jan | Not So Big Co. Ltd |

1003 |

10,000.00 |

| 30-Jan | Not So Small Co. Ltd |

1004 |

7,000.00 |

The Sales Journal or Sales Day Book of ABC Co. Ltd would show the details of the sales as follows: –

|

Example of Sales Journal or Sales Day Book |

||||

| ABC Co. Ltd | ||||

| Sales Day Book | ||||

| Page 1 | ||||

| Date | Descriptions | Invoice No. | Folio |

$ |

| 2007 | ||||

| 01-Jan | Big Co. Ltd | 1001 | SL3 | 3,000.00 |

| 02-Jan | Small Co. Ltd | 1002 | SL20 | 5,000.00 |

| 15-Jan | Not So Big Co. Ltd | 1003 | SL5 | 10,000.00 |

| 30-Jan | Not So Small Co. Ltd | 1004 | SL6 | 7,000.00 |

| 25,000.00 | ||||

|

GJ1 |

||||

Based on the four sales transactions of ABC Co. Ltd for the month of January 2007, the extracts of the Sales Ledger or Debtors Ledger are as follows: –

|

Extracts of Sales Ledger or Debtors Ledger |

|||||||

|

ABC Co. Ltd |

Page 3 |

||||||

|

Sales Ledger |

|||||||

|

Big Co. Ltd |

|||||||

|

DEBIT |

CREDIT |

||||||

| Date | Descriptions | Folio |

$ |

Date | Descriptions | Folio |

$ |

| 2007 | 2007 | ||||||

| 01-Jan | Sales | SDB1 | 3,000.00 | ||||

|

ABC Co. Ltd |

Page 5 |

||||||

|

Sales Ledger |

|||||||

|

Not So Big Co. Ltd |

|||||||

|

DEBIT |

CREDIT |

||||||

| Date | Descriptions | Folio |

$ |

Date | Descriptions | Folio |

$ |

| 2007 | 2007 | ||||||

| 15-Jan | Sales | SDB1 | 10,000.00 | ||||

|

ABC Co. Ltd |

Page 6 |

||||||

|

Sales Ledger |

|||||||

|

Not So Small Co. Ltd |

|||||||

|

DEBIT |

CREDIT |

||||||

| Date | Descriptions | Folio |

$ |

Date | Descriptions | Folio |

$ |

| 2007 | 2007 | ||||||

| 30-Jan | Sales | SDB1 | 7,000.00 | ||||

|

ABC Co. Ltd |

Page 20 |

||||||

|

Sales Ledger |

|||||||

|

Small Co. Ltd |

|||||||

|

DEBIT |

CREDIT |

||||||

| Date | Descriptions | Folio |

$ |

Date | Descriptions | Folio |

$ |

| 2007 | 2007 | ||||||

| 02-Jan | Sales | SDB1 | 5,000.00 | ||||

Take note of the Folio column of both the Sales Day Book and the Sales Ledger. Could you see the connections? The Folio column is used to locate the relevant page of each transaction. On each of the relevant page of the Sales Ledger, you see an “Account” is created for each trade debtor. One distinct feature of an Account in accounting is that it must have a DEBIT side and also a CREDIT side in order to show the rules of DOUBLE ENTRY system that have been discussed in my previous posts. On the other hand, the Sales Day Book DOES NOT have accounts in it! It is just a listing showing the sales transactions of ABC Co. Ltd in chronological order – i.e. a journal. At the end of January 2007 (31January 2007), each transaction in the “$” column of the Sales Day Book is then added up together to arrive at the month end total of $25,000. Based on the total sales transactions of $25,000 a journal entry is created in the General Journals as follows: –

|

Extract of General Journals |

||||

| ABC Co. Ltd | Page 1 | |||

| General Journals | ||||

| Date | Descriptions | Folio | Debit | Credit |

| 2007 | ||||

| 31-Jan | Trade Debtors | GL20 | 25,000.00 | |

| Sales | GL30 | 25,000.00 | ||

| (Being sales for the month of January 2007) | ||||

Using the above journal, the sales for the month of January 2007 are “posted” to the General Ledger – meaning is recorded in the General Ledger. The relevant pages of the General Ledger after the “posting” of the January 2007’s sales is as follows: –

|

Extracts of General Ledger |

|||||||

|

ABC Co. Ltd |

Page 20 |

||||||

|

General Ledger |

|||||||

|

Trade Debtors |

|||||||

|

DEBIT |

CREDIT |

||||||

| Date | Descriptions | Folio |

$ |

Date | Descriptions | Folio |

$ |

| 2007 | 2007 | ||||||

| 31-Jan | Sales | GJ1 | 25,000.00 | ||||

|

ABC Co. Ltd |

Page 30 |

||||||

|

General Ledger |

|||||||

|

Sales |

|||||||

|

DEBIT |

CREDIT |

||||||

| Date | Descriptions | Folio |

$ |

Date | Descriptions | Folio |

$ |

| 2007 | 2007 | ||||||

| 31-Jan | Trade Debtors | GJ1 | 25,000.00 | ||||

Assume ABC Co. Ltd commenced its business on 1 January 2007 by way of injecting $10,000 cash into its bank account. In addition, the total purchases transaction in the month of January 2007 was $20,000 (The recording of the transactions in the Purchases Day Book or Purchases Journal and also the Creditors Ledger or Purchases Ledger is similar to the sales transactions & therefore is not shown), the journal entries in the General Journals and the relevant pages of the General Ledger are as follows: –

|

Extract of General Journals |

||||

| ABC Co. Ltd |

Page 1 |

|||

| General Journals | ||||

| Date | Descriptions | Folio | Debit | Credit |

| 2007 | ||||

| 01-Jan | Cash at Bank | GL1 | 10,000.00 | |

| Share Capital | GL2 | 10,000.00 | ||

| (Being injection of cash as initial capital) | ||||

| 2007 | ||||

| 31-Jan | Purchases | GL35 | 25,000.00 | |

| Trade Creditors | GL25 | 25,000.00 | ||

| (Being purchases for the month of January 2007) | ||||

|

|

|||||||

|

ABC Co. Ltd |

Page 1 |

||||||

|

General Ledger |

|||||||

|

Cash at Bank |

|||||||

|

DEBIT |

CREDIT |

||||||

| Date | Descriptions | Folio |

$ |

Date | Descriptions | Folio |

$ |

| 2007 | 2007 | ||||||

| 31-Jan | Share Capital | GJ1 | 10,000.00 | ||||

|

ABC Co. Ltd |

Page 2 |

||||||

|

General Ledger |

|||||||

|

Share Capital |

|||||||

|

DEBIT |

CREDIT |

||||||

| Date | Descriptions | Folio |

$ |

Date | Descriptions | Folio |

$ |

| 2007 | 2007 | ||||||

| 31-Jan | Cash at Bank | GJ1 | 10,000.00 | ||||

|

ABC Co. Ltd |

Page 25 |

||||||

|

General Ledger |

|||||||

|

Trade Creditors |

|||||||

|

DEBIT |

CREDIT |

||||||

| Date | Descriptions | Folio |

$ |

Date | Descriptions | Folio |

$ |

| 2007 | 2007 | ||||||

| 31-Jan | Purchases | GJ1 | 20,000.00 | ||||

|

ABC Co. Ltd |

Page 35 |

||||||

|

General Ledger |

|||||||

|

Purchases |

|||||||

|

DEBIT |

CREDIT |

||||||

| Date | Descriptions | Folio |

$ |

Date | Descriptions | Folio |

$ |

| 2007 | 2007 | ||||||

| 31-Jan | Trade Creditors | GJ1 | 20,000.00 | ||||

Assume ABC Co. Ltd “closes” its accounts for the month of January 2007, ABC Co. Ltd would then compute the total of each of the account in the General Ledger and arrive at the respective closing balance (Balance C/F) shown as follows: –

|

Extracts of General Ledger |

|||||||

|

ABC Co. Ltd |

Page 1 |

||||||

|

General Ledger |

|||||||

|

Cash at Bank |

|||||||

|

DEBIT |

CREDIT |

||||||

| Date | Descriptions | Folio |

$ |

Date | Descriptions | Folio |

$ |

| 2007 | 2007 | ||||||

| 31-Jan | Share Capital | GJ1 | 10,000.00 | 31-Jan | Balance C/F | 10,000.00 | |

| 10,000.00 | 10,000.00 | ||||||

|

ABC Co. Ltd |

Page 2 |

||||||

|

General Ledger |

|||||||

|

Share Capital |

|||||||

|

DEBIT |

CREDIT |

||||||

| Date | Descriptions | Folio |

$ |

Date | Descriptions | Folio |

$ |

| 2007 | 2007 | ||||||

| 31-Jan | Balance C/F | 10,000.00 | 31-Jan | Cash at Bank | GJ1 | 10,000.00 | |

| 10,000.00 | 10,000.00 | ||||||

|

ABC Co. Ltd |

Page 20 |

||||||

|

General Ledger |

|||||||

|

Trade Debtors |

|||||||

|

DEBIT |

CREDIT |

||||||

| Date | Descriptions | Folio |

$ |

Date | Descriptions | Folio |

$ |

| 2007 | 2007 | ||||||

| 31-Jan | Sales | GJ1 | 25,000.00 | 31-Jan | Balance C/F | 25,000.00 | |

| 25,000.00 | 25,000.00 | ||||||

|

ABC Co. Ltd |

Page 25 |

||||||

|

General Ledger |

|||||||

|

Trade Creditors |

|||||||

|

DEBIT |

CREDIT |

||||||

| Date | Descriptions | Folio |

$ |

Date | Descriptions | Folio |

$ |

| 2007 | 2007 | ||||||

| 31-Jan | Balance C/F | 20,000.00 | 31-Jan | Purchases | GJ1 | 20,000.00 | |

| 20,000.00 | 20,000.00 | ||||||

|

ABC Co. Ltd |

Page 30 |

||||||

|

General Ledger |

|||||||

|

Sales |

|||||||

|

DEBIT |

CREDIT |

||||||

| Date | Descriptions | Folio |

$ |

Date | Descriptions | Folio |

$ |

| 2007 | 2007 | ||||||

| 31-Jan | Balance C/F | 25,000.00 | 31-Jan | Trade Debtors | GJ1 | 25,000.00 | |

| 25,000.00 | 25,000.00 | ||||||

|

ABC Co. Ltd |

Page 35 |

||||||

|

General Ledger |

|||||||

|

Purchases |

|||||||

|

DEBIT |

CREDIT |

||||||

| Date | Descriptions | Folio |

$ |

Date | Descriptions | Folio |

$ |

| 2007 | 2007 | ||||||

| 31-Jan | Trade Creditors | GJ1 | 20,000.00 | 31-Jan | Balance C/F | 20,000.00 | |

| 20,000.00 | 20,000.00 | ||||||

C/F is “Carried Forward”. Each of these month end balances will be the beginning balance for the month of February 2007. The Balance C/F of each account in the General Ledger is calculated by computing the difference of the total debit column and the total credit column of that account. Based on the Balance C/F of EACH account in the General Ledger, a Trial Balance is prepared and look like this: –

|

ABC Co. Ltd |

|||

|

Trial Balance as at 31 January 2007 |

|||

| Debit | Credit | ||

| $ | $ | ||

| GL1 | Cash at Bank | 10,000.00 | |

| GL2 | Share Capital | 10,000.00 | |

| GL20 | Trade Debtors | 25,000.00 | |

| GL25 | Trade Creditors | 20,000.00 | |

| GL30 | Sales | 25,000.00 | |

| GL35 | Purchases | 20,000.00 | |

| 55,000.00 | 55,000.00 | ||

Trial Balance is a tool to detect errors in transactions recording. This is because, using the double entry system, each transaction MUST be recorded two times – One debit entry and one credit entry. Using the logic of double entry system, the total debit balances of all the accounts in the General Ledger MUST tally with the total of all the accounts with credit balances. After the Trial Balance is prepared, the Balance Sheet of ABC Co. Ltd. as at 31 January 2007and the Income Statement of ABC Co. Ltd for the month of January 2007 would then be prepared: –

|

ABC Co. Ltd |

||||

| Income Statement for the month of January 2007 | ||||

|

$ |

||||

| Sales |

25,000.00 |

A |

||

| Cost of Sales: | ||||

| Opening Inventories |

– |

B |

||

| Purchases |

-20,000.00 |

C |

||

| Closing Inventories |

– |

D |

||

|

-20,000.00 |

E = B+C-D |

|||

| Gross Profit |

5,000.00 |

F = A+E |

||

| Other Income |

– |

G |

||

| Other Expenses |

– |

H |

||

| Net Profit |

5,000.00 |

I = F+G+H |

||

| ABC Co. Ltd | ||||

| Balance Sheet as at 31 January 2007 | ||||

|

$ |

||||

| Assets | ||||

| Trade Debtors |

25,000.00 |

J |

||

| Cash at Bank |

10,000.00 |

K |

||

|

35,000.00 |

L = J+K |

|||

| Liabilities | ||||

| Trade Creditors |

-20,000.00 |

M |

||

|

15,000.00 |

N = L+M |

|||

| Owners’ Equity | ||||

| Share Capital |

10,000.00 |

O |

||

| Accumulated Profits |

5,000.00 |

P |

||

|

15,000.00 |

Q = O+P |

|||

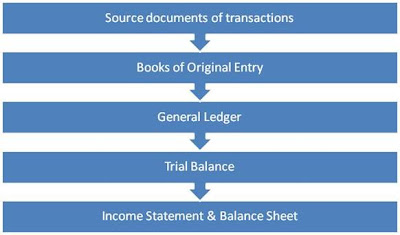

The process chart on how transactions are recorded, summarised posted to the General Ledger up to the stage of the preparation of the Balance Sheet and the Income Statement is as follows: –